Free Trade So Long As It's Fair Trade

It is common to hear farmers say, “we support free trade so long as it is fair trade.” The Florida Tomato Exchange shares that sentiment, but acknowledges that fair trade is difficult to prescribe, especially among trading partners that have vast differences in terms of labor wages, worker rights, government regulations, and rule of law.

We believe such discrepancies should be taken into consideration when free trade deals are negotiated and that robust enforcement against unfair trade practices is paramount.

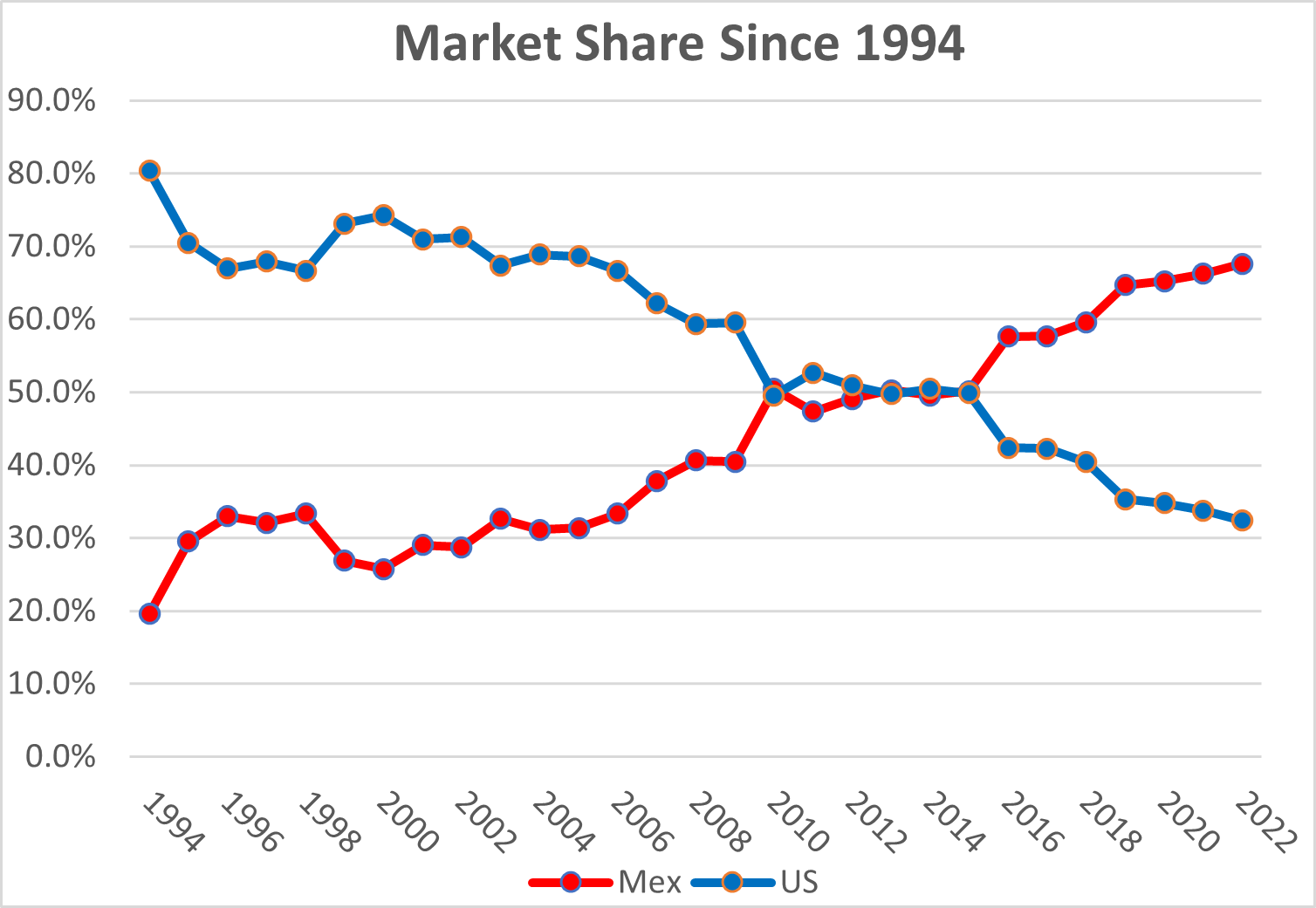

International trade has a significant impact on Florida’s tomato growers, packers, and shippers. Approximately 15 percent of the Florida tomato crop is exported each year, mostly to Canada, with a small portion also destined to various Caribbean countries. It is imported tomatoes, however, that are of most consequence for the Florida tomato industry. Florida’s growing season coincides with the peak season for tomato growers in Mexico – mostly in the Mexican state of Sinaloa. Since 1994, the year NAFTA was implemented, the Florida industry has been decimated by an influx of cheap Mexican tomatoes. Florida’s tomato industry has been cut in half during that time with hundreds of growers being forced out of the business.

Not Just a Florida Story

Traditionally, the biggest volumes of Mexican tomatoes were imported during the winter and spring, competing directly with Florida growers. But starting around 2006, the Mexican industry began increasing production in the summer and fall months, fueled in part by Mexican government subsidies. By 2010, tomato growers in California, Georgia, Michigan, New Jersey, and other summer producing states, began to be squeezed by increasing imports of Mexican tomatoes during the summer and fall seasons. Since 2010, Mexican imports during the summer and fall have increased at over twice the pace as imports during the Florida season. What was once just a problem for winter tomato growers in Florida has now become a national problem for the whole U.S. tomato industry.

Mexican tomato imports to the U.S. have skyrocketed nearly 400 percent, from just over 800 million pounds in 1994 to approximately four billion pounds in 2022.

Unfair Trade and the Tomato Suspension Agreement

In 1996, the U.S. tomato industry – led by the Florida Tomato Exchange – filed an antidumping petition against Mexican imports. This led to an investigation by the U.S. Department of Commerce, which preliminarily found that Mexican exporters were illegally dumping tomatoes in the U.S. market. Before the investigation was fully adjudicated, however, the Commerce Department entered into negotiations with the Mexican tomato industry, resulting in what is known as the Tomato Suspension Agreement. The agreement suspended the dumping investigation in exchange for Mexican exporters agreeing to not sell tomatoes into the U.S. below certain reference prices.

In 2019, after decades of complaints by U.S. growers that the suspension agreement wasn’t working, the Commerce Department reopened the dumping investigation. The new investigation determined that Mexican dumping had continued – even with a suspension agreement in place – at margins as high as 30.48 percent and an average rate of 20.91 percent. In November 2019, the U.S. International Trade Commission determined the domestic industry was being injured by this dumping. But because the suspension agreement had been renegotiated earlier that same year, the antidumping duties continue to be suspended from being applied to imports of Mexican tomatoes.

The suspension agreement that was renegotiated in 2019 was supposed to close the loopholes that had rendered the previous agreements ineffective. Unfortunately, the 2019 agreement has also proven to be unenforceable and easily violated by Mexican dumping. Therefore, in June 2023, the Florida Tomato Exchange filed a request for the Commerce Department to terminate the agreement. A decision on the matter is pending.

It is the Florida Tomato Exchange’s position – a position that is widely supported by tomato growers across the U.S. – that the Mexican industry had their day in court in 2019 to prove they were not dumping. They lost at both the Department of Commerce and the U.S. International Trade Commission. The failure of the suspension agreement to stop Mexican dumping means that antidumping duties must be imposed on Mexican tomato imports, as required by U.S. antidumping law, and as allowed for by the WTO and USMCA.